The traditional survey on PVC consumption in Italy in 2020, carried out by Plastic Consult on behalf of PVC Forum Italia, shows a total of 590,000 tons of processed PVC, a decrease of about 7% compared to the previous year.

The reduction is in line with that of the Italian thermoplastics market, which went from 5.69 million tonnes in 2019 to 5.36 million last year (- 6%), returning to 2014 levels.

These data are certainly related to the Covid 19 emergency that has strongly influenced the different markets for much of 2020, distorting the prospects of the entire industrial sector including the plastics sector.

The global health emergency also had direct consequences for final consumption, which fell sharply, with a strong propensity of households to save, and very negative industrial production, especially in march-April-May. The construction and construction sector did not start again until July with the ecobonus being driven by 110%.

In the final part of the year there was a slight recovery in consumption. Returning to PVC, the total 590,000 tons processed in Italy are divided between 287,000 tons of rigid PVC and 303,000 tons of plasticized PVC which proportionately lost a little less than the first. 64% of the total is PVC resin and the remaining 36% compound.

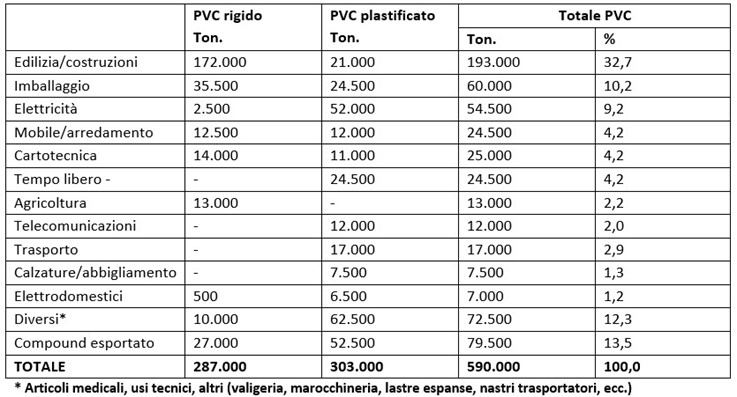

The breakdown of PVC consumption, by type and application sector photographed in 2020, substantially reflects the breakdown recorded in recent years, as shown in the following table:

Construction, historically the leading application sector of PVC, with 193,000 records a decline in line with the general polymer sector (-7%) and with that of electricity-related applications (especially flexible protective PVC of cables and wires).

More marked, around 15%, is the reduction of packaging (60,000 t.) and furniture/furnishings (24,500 t.). Finally, it should be noted that the exported compound is excellently maintained, losing only 2% and confirming the application sector least affected by the consequences of the pandemic.

With regard to recycled PVC, the reduced availability of pre-consumer waste to be initiated into regeneration has been added to the unfavourable price positioning of post-consumer recycled products, which has held back its development.

The total production of recycled stops at volumes around 80/85 Kton, with post-consumption representing about 30%.

A concrete help to this sector can come from our R-PVC Hub,aplatform of “collaboration” between all the actors of PVC recycling: those who collect waste, those who process it and those who produce items containing recycled. For the immediate future, new opportunities could result from a constructive management of the crisis still in progress, perhaps exploiting potential synergies or collaborations between companies, at all levels.

For example, through research and innovation to propose new solutions to a changing society, creating or re-inventing new industrial PVC applications and focusing on hygiene and sterility that will remain drivers for the coming years. At the macro level, in 2021 there will be a rebound in the Italian economy and industrial production, both destined for the domestic and foreign markets. After recovery in the terminal part of 2020, for rigid PVC the year opened with a good level of demand in numerous applications. Plastic PVC also closed last year in recovery and the outlook for the current year is favourable. Demand is on average toned and almost all major applications are expected to grow. For recycled products, the external and regulatory environment is conducive to their development with an increasing demand for products with a higher recycling content.